Two-factor authentication

Click and Identify – Authentication via SMS

In times of digital and interactive communication, you’re never quite sure who’s actually on the other end of the line. Is it a person, a machine, an attacker?

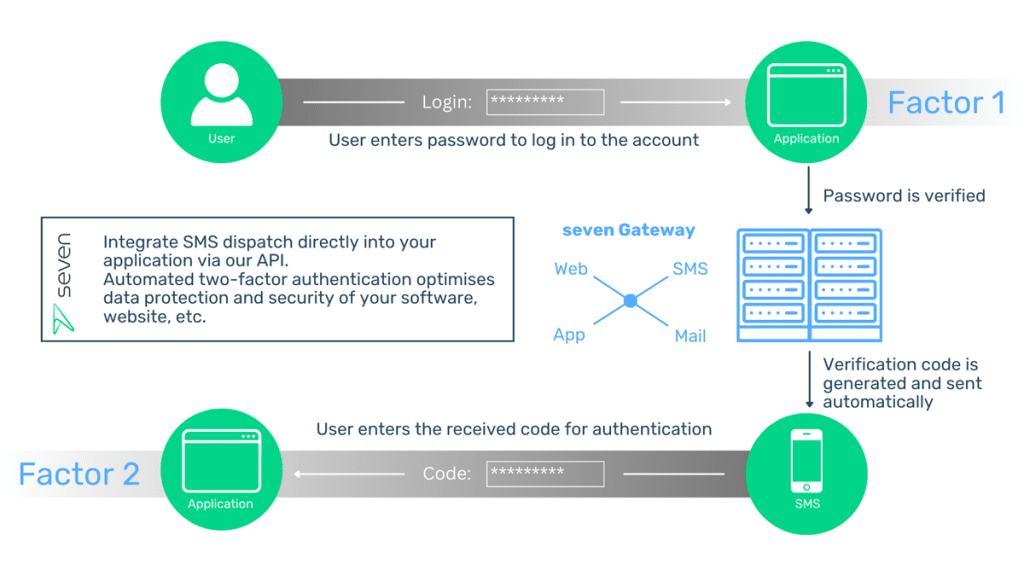

To help you rule out misuse of mobile information by third parties, we offer you a high-quality SMS procedure for two-factor authentication (2FA). In two-factor authentication, proof of identity is provided by combining two different factors. These are transmitted independently of each other and then verified.

2FA is a form of multi-factor authentication that can also include more than two factors. To increase security, a combination of the factors knowledge, possession, and inherence is usually requested; other factors are rarely used. For two-factor authentication, the knowledge and possession factors are the most common. In this case, using a password and confirmation code sent via SMS is very popular.

Two components

– one goal: Authentication

Two factors are usually sufficient for authentication. They can be transmitted manually or automatically and can take a wide variety of forms. The only important thing is that they are submitted independently of each other. Many factors are perfect for our SMS dispatch, others are not:

Two-Way-Massaging (SMS2Mail, Mail2SMS, App)

Passwords, identification numbers

PIN, TAN numbers, codes

Security questions (e.g., pet name)

Barcode scanning

Keys, cards with implemented chips

Identity card

Fingerprint

Voice or speech pattern recognition

Eye scan (iris recognition)

Looking to send or receive one factor of the authentification via SMS? We offer a professional SMS procedure for your mobile communication and authentication. The information is sent immediately and reaches your users everywhere – worldwide.